Banking clients have grown tired of nearly zero deposit rates in recent years and in some cases, we are seeing negative interest rates on deposits. Traditional banking, in general, is becoming less profitable. That’s where «crypto-fiat» banks are entering to fill the void. The new crypto economy and crypto banks allow depositing assets at relatively high rates, a dream in the old world. The new industry allows crypto banks to raise funds at 6–12 % and sell at an average of 16–70 %. And all of that with incredibly low transaction costs.

So, the crypto industry could make banking profitable again!

Cryptocurrency has found its place in the list of assets for traditional, commercial and investment banks.

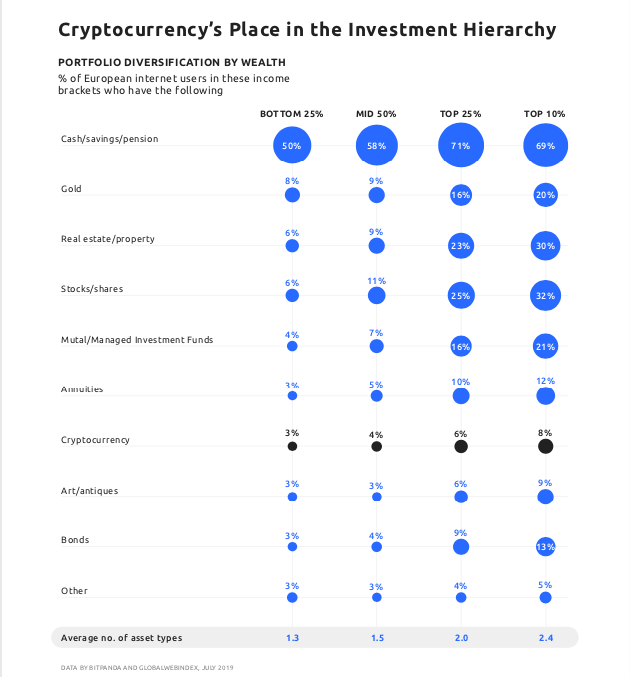

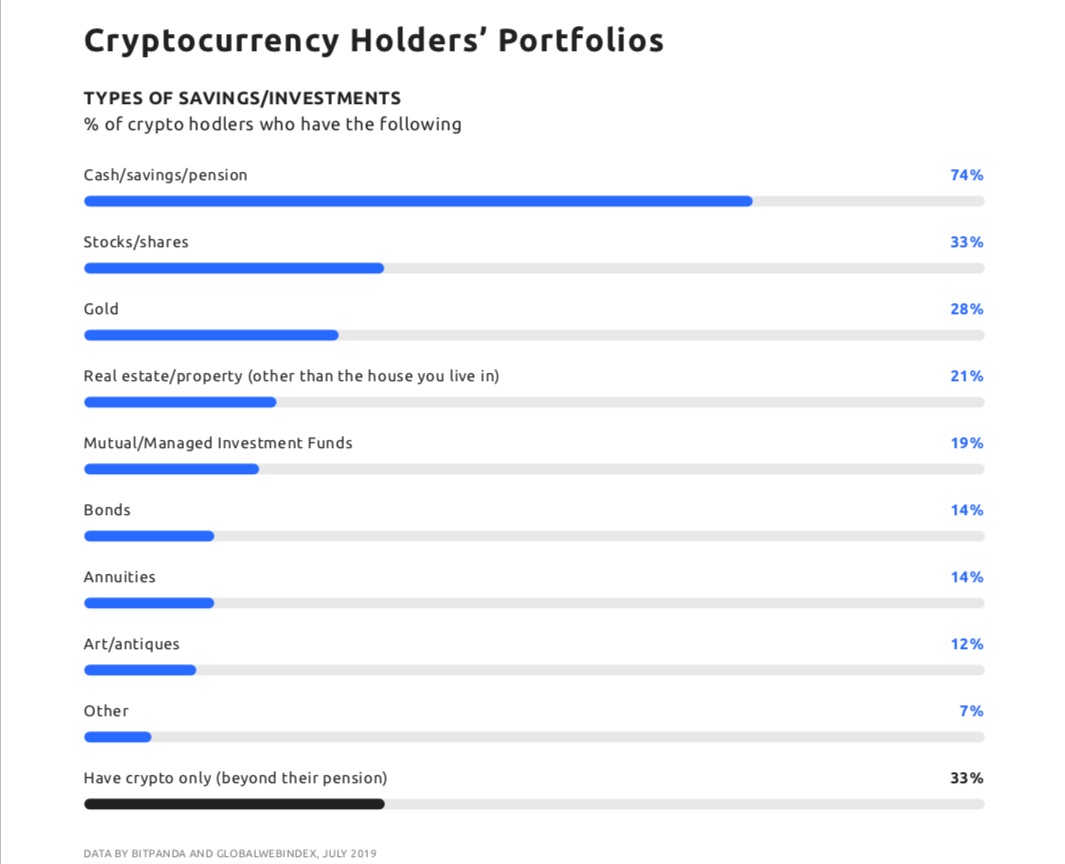

A Bitpanda and GlobalWebindex report states that crypto-assets are already more popular than art/antiques and bonds among active European internet users.

At the same time, two out of three crypto hodlers actively use traditional saving and investment products.

So, it is not surprising that both traditional financial institutions and new players are actively working to integrate digital assets into the financial market infrastructure.

Founded back in 1964 investment firm Fidelity, for example, launched a platform for Bitcoin and Ethereum. In more recent news, the much talked about Bakkt — platform backed my NYCE and ICE was the first fully regulated and compliant platform of its kind to offer monthly Bitcoin futures. The National Bank of Canada, Barclays and even hyper-conservative Wells Fargo and Goldman Sachs are demonstrating their involvement in the crypto-industry.

Peter Wuffl, the former CEO of Switzerland’s biggest bank, UBS, recently took up the role as director for the newly created Swiss crypto bank Sygnum.

Sygnum is just the second crypto bank (along with SEBA) to receive a banking license from a financial regulator. In many ways, this is a perfect example of what the new banking industry may look like. Here, we have a major figure from the traditional world of finance bringing his expertise and wisdom into the new world. Combining the regulatory framework of traditional banks with that of new innovative startups is how this industry will efficiently evolve into its next stage.

Speaking about innovative projects — look at FinTech platform YouHodler, for example. YouHodler offers high-yield crypto savings accounts in USD and EUR with interest rates as high as 12 % — a dream in the old world and with sell rates at an average of 16–70%. They are numbers that cannot be ignored and they became possible because of efficient integration of crypto into the mechanics of traditional financial products — for example secured loans in dollars and euros with higly-volatile digital assets like Bitcoin and Altcoin as collateral.

Another great example is the UK-based crypto-wallet Wirex which enables crypto exchange with 25+ cryptocurrencies and fiat currencies using its built-in exchange. Wirex also has a debit card, allowing users to spend USD, GBP or EUR on their Wire account and giving users 0.5 % cashback in Bitcoin for each purchase made.

When Bitcoin first arrived in 2009, many predicted it would one day defeat the machine that is «big banks». Yet, a decade later, we see nothing like that and realistically it will not happen at all. Banking practices can be traced back to the Roman empire. Since then, they’ve more or less served the same purposes.

Bitcoin and Blockchain become just a great tool to make banking an efficient business again. So, the future of traditional banking will not experience what the taxi and hotel industries experienced after Uber and Airbnb, at least not because of crypto.